At the same time three-year ahead inflation expectations ticked down to 37 from 38. While the fourth quarter CPI reading could mark an inflation peak.

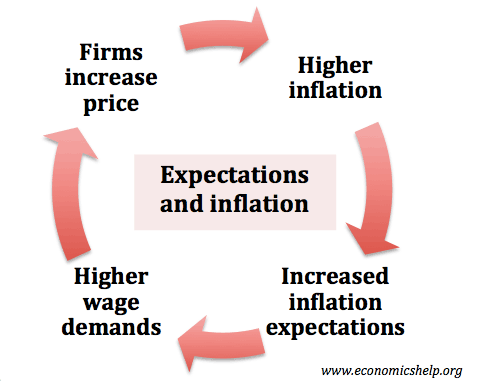

The Role Of Price Expectations In Inflation Economics Help

In the capital asset pricing model an increase in inflationary expectations will be reflected by a.

. The latest inflation reading from the Consumer Price Index came in at 68 the highest year-over-year increase since 1982. For most economic commentators the underlying driving force of general price increases which they label as inflation is inflationary expectations1 For instance if there is a sharp increase in the price of oil individuals may form higher inflationary expectations that could set in motion increases in the prices of goods and services or so. Median one-year ahead inflation expectations jumped to 66 in March a new series high from 60 in February.

13 hours agoConsumers expected inflation to reach 47 over the next 12 months in data collected before the invasion. This increases todays prices by increasing todays demand. C shift to the left.

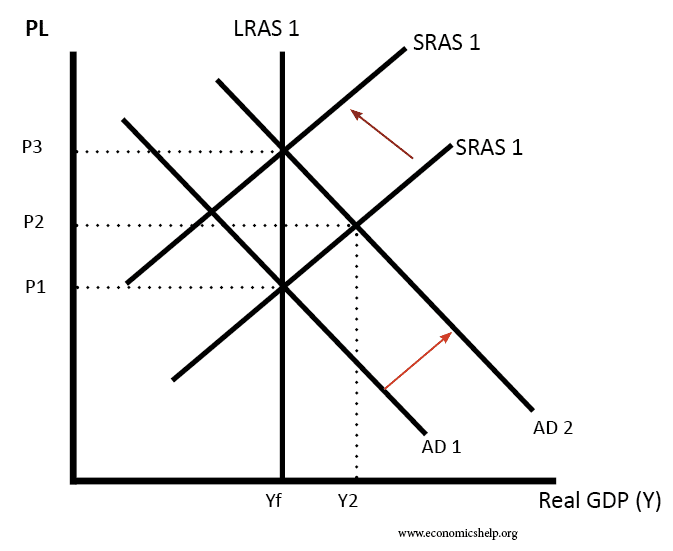

An increase in the slope of the security market line. Later we saw increases in car prices and other components that pushed inflation upward. A decrease in the inflationary expectations causes a decrease leftward shift of the aggregate curve.

The breakeven rate spread between market rate and inflation. 57 minutes agoCanadas Inflation Blows Past Expectations Hits 67 in March. Treasury bond closed at 201 percent on Friday up from 165 percent at the beginning of the year.

On this account workers care about real wages and keep expected inflation in view when bargaining over. Inflation Expectations Increase Heres Why Thats Okay. Thus inflation expectations have created inflation.

At the beginning of the COVID-19 pandemic while inflation was low we saw an increase in inflation expectations. This could be a result of food prices that were growing at a faster rate than other prices because of supply chain restrictions. Bloomberg -- Canadian consumer price inflation shot past expectations in March jumping to a new three-decade high and cementing.

Group of answer choices. An increase in inflationary expectations would cause the aggregate supply to Select increase keep constant fluctuate fall in the short run. Inflation Expectations Increase in the Short-Term Remain Stable in the Medium-Term May 10 2021 NEW YORKThe Federal Reserve Bank of New Yorks Center for Microeconomic Data released the April 2021 Survey of Consumer Expectations which shows that median inflation expectations increased at the short-term horizon but remained.

An increase in the inflationary expectations causes an increase rightward shift of the aggregate curve. Thus they consider this rate while basing their decisions concerning various economic activities that they would like to undertake in the future. 3 hours agoInflation expectations were two-tenths of one percent higher for 2023 and 2024 slightly lower for 2025-27 while long-term inflation expectations 2028-2051 were a few tenths of one percent.

When factors other than price level that affect the quantity of goods and services supplied change. Other notable aggregate demand determinants include interest rates federal deficit and the money supply. Median one-year-ahead inflation expectations increased to a new series high of 66 from 60 in February while median three-year ahead inflation expectations decreased to 37 from 38.

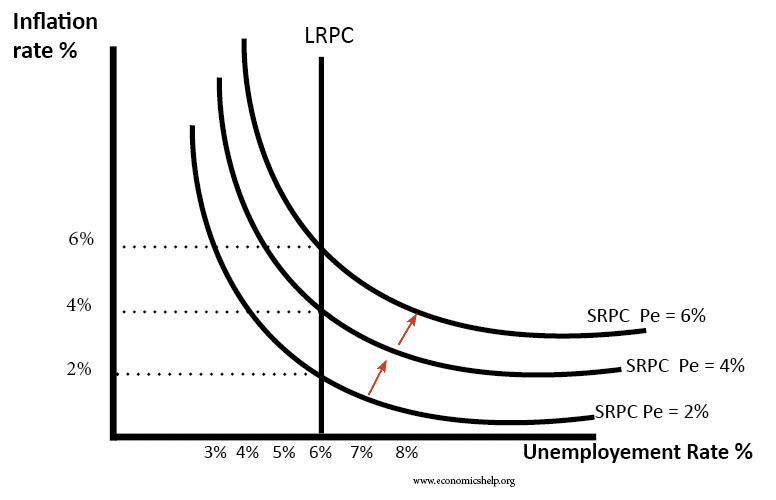

Long-term inflation expectations for the next five and ten years on average were also. To illustrate an increase in inflation and unemployment with. For most economic commentators the underlying driving force of general price increases which they label as inflation is inflationary expectations1 For instance if there is a sharp increase in the price of oil individuals may form higher inflationary expectations that could set in motion increases in the prices of goods and services or so it is held.

D shift to the right. First we saw yields rise in the bond market. Inflation Expectations refer to the opinion on the future inflation rate from different sections of the society including investors bankers central banks workers business people.

There were multiple signs last week suggesting that inflation expectations have risen. The increase in short-term expectations was broad-based across age education and income groups. If inflation expectations rise SRAS shifts leftward raising the price level and unemployment stagflation.

A parallel shift upward in the security market line. A decrease in the slope of the security market line. Inflation expectations are a determinant of the short-run aggregate supply curve.

An increase in inflation expectations pulls future consumption to the present. A parallel shift downward in the security market line. 23 hours agoConsider the Federal Reserve Bank of New Yorks recent Survey of Consumer Expectations which showed in March that Americans believed inflation will rise 66 over the next year an increase.

An increase in inflationary expectations that causes firms to increase their prices shifts the. The second story centers on the wage channel. When the short-run aggregate supply curve shifts one direction the short-run Phillips curve shifts the opposite direction.

If inflationary expectations increase the Phillips curve will. After the start of the war the expected inflation rate increased to 56 while the median increased from 5 control group to 55 treatment group.

0 Comments